World Cup phenom already has deals with Nike, McDonald's—more on the way?

Following his gutsy performance for Team USA in the FIFA World Cup, goalkeeper Tim Howard is preparing for a big score.

Following his gutsy performance for Team USA in the FIFA World Cup, goalkeeper Tim Howard is preparing for a big score.

The 35-year-old American, who also plays for Everton in England, became a media darling in the wake of America’s July 1 knockout-round loss to Belgium. Now, he’s looking to cash in on his newfound celebrity and break into the elite endorsement leagues. (He currently has six-figure deals with Nike and McDonald’s, making him a small fry in the rarified world of big-time sponsorships.)

“People’s perception of me may have changed in the past two weeks, but I haven’t changed a bit,” says Howard, who adds that he’s seeking the same kinds of deals as always: “blue-chip opportunities [with] really good companies with good reputations.”

Howard’s agent, Dan Segal of Wasserman Media Group, says his client has received dozens of offers in the past two weeks, and that he’s close—perhaps just days away—from inking deals with at least three national advertisers. “We’re looking for things consistent with his image,” which is down-to-earth and hardworking, rather than flashy or glitzy, Segal says. “We don’t feel in any way, shape or form a desperation to try and grab everything that comes along.”

Howard’s ascension stands in contrast to the fate that befell 22-year-old Neymar da Silva Santos Júnior (universally known as Neymar), the Brazilian striker who also plays for FC Barcelona in Europe. The 2014 World Cup was billed as Neymar’s showcase, and some predicted that he would enhance his superstar status by leading Team Brazil to a title in front of its home-country fans. Instead, Neymar will spend several weeks immobilized in a back brace after suffering a broken vertebra in Brazil’s quarterfinal victory over Colombia. (His team was routed 7-1 by Germany in the following round.)

In March, Neymar was feted as “The Next Pelé” by Time magazine, in a nod to his countryman who reigned as the global face of soccer a generation ago. SportsPro Media ranked Neymar as the world’s most marketable athlete, and this year he’ll earn $16 million from endorsements alone, per Forbes. The injury, however, puts his future, both on and off the field, in jeopardy. Needless to say, Neymar’s brand-building value will plummet if he can’t regain his form. Luckily, he won’t require surgery, and as long as he comes back healthy, he should reclaim his stature as a top endorser, experts say.

As for Howard, “Tim can make some money in the U.S. I wouldn’t call it a big payday compared to other athletes,” says Paul Danforth, head of global sales at CAA Sports. Manish Tripathi, a marketing professor at Emory University who focuses on sports, advises Howard to “make deals as soon as possible. Once the World Cup ends, the enthusiasm will wane. Think Landon Donovan after he had the big goal against Algeria in the last World Cup.”

The disparate circumstances of Howard and Neymar underscore key issues for brands seeking to leverage sports. Sometimes bankable stars get injured or sullied by scandals, limiting their value. And while signing Howard might seem like a good idea right now, he’s no youngster, and his glow could soon fade.

“With risk comes reward,” says Danforth. “With elite athletes, their global reach far outweighs the downside.” The synthesis of athletes and brands is nothing new—and the scope of such relationships is more profound than ever, with huge player, team and league deals seemingly announced every week. Experts say that all signs point to increasingly lucrative contracts for the foreseeable future.

Bull Market

The elevation of sports within the marketing mix stems mainly from “the shift from a world of passive consumption, where fans primarily fed their passion for sports through traditional broadcast and print media, to the world of interactive new media,” says Simon Wardle, chief strategy officer at sports, music and entertainment marketing firm Octagon. “Time shifting, on-demand programming and other shifts in consumption of traditional entertainment content have made above-the-line media less effective. Sport is one entertainment medium still capable of consistently aggregating and delivering large audiences who share a passion for the content and will commit to watching it live.”

Bull Market

The elevation of sports within the marketing mix stems mainly from “the shift from a world of passive consumption, where fans primarily fed their passion for sports through traditional broadcast and print media, to the world of interactive new media,” says Simon Wardle, chief strategy officer at sports, music and entertainment marketing firm Octagon. “Time shifting, on-demand programming and other shifts in consumption of traditional entertainment content have made above-the-line media less effective. Sport is one entertainment medium still capable of consistently aggregating and delivering large audiences who share a passion for the content and will commit to watching it live.”

That new reality has been brought into sharp focus by the explosion in digital devices, literally putting games—and sponsor messages—in the hands of fans everywhere. “The whole digital universe is available to one of the most highly consumable types of content—sports,” notes Octagon CEO Rick Dudley. Thanks to modern media analytics, “we can quantify how much value you can get, [and help you] reach a specific demo using a certain tone.”

Based on this dynamic, Wardle believes, “you will continue to see more brands investing in below-the-line, passion-based marketing assets. International events like the FIFA World Cup, Olympic Games, Rugby World Cup and Wimbledon aggregate millions of global consumers at one time, which can be an attractive media buy if you’re a global or pan-regional brand.”

Data from IEG supports that analysis. The research and consulting firm projects $40.4 billion in global sports sponsorship spending in 2014, up $8.8 billion over the past five years, and more than double what it was a decade ago. Global marketers have increased overall sponsorship spending to 23 percent of their budgets (compared to 16 percent a decade ago), with approximately 70 percent of those dollars earmarked for sports. “We are bullish that the healthy growth we have been seeing should continue,” says IEG svp Jim Andrews. “There are no dark clouds on the horizon.”

The future looks especially bright for soccer, which ranks as the top team sport in most overseas markets, while its domestic popularity continues to rise. Team USA’s June 22 tie with Portugal and its July 1 loss to Belgium in the World Cup rank as ESPN’s most-watched soccer broadcasts ever, with audiences of 18.2 million and 16.5 million, respectively. On a global scale, IEG says FIFA will make $1.68 billion in sponsorships for the 2014 Cup cycle, almost half a billion more than it did in 2010.

Soccer Kicks A$$

“Soccer is helping sports marketing blow up globally,” says CAA’s Danforth. One salient example: General Motors’ Chevrolet is paying a mind-boggling $560 million to put its golden bow tie on Manchester United’s jerseys for seven years starting with the 2014-15 season.

“Soccer is helping sports marketing blow up globally,” says CAA’s Danforth. One salient example: General Motors’ Chevrolet is paying a mind-boggling $560 million to put its golden bow tie on Manchester United’s jerseys for seven years starting with the 2014-15 season.

“While there are opportunities for U.S.-based brands to market internationally using soccer—such as GM’s Manchester United kit sponsorship—there seems to be even more opportunity for global brands to connect with American customers via sponsorship of clubs finding appeal among U.S. fans,” says Donald Roy, a sports promotions expert and professor of management and marketing at Middle Tennessee State University.

FC Barcelona is a juggernaut, owing to its winning ways, star power (Neymar and Lionel Messi) and reach that includes weekly match broadcasts in 200 countries and 320 million fans and followers online. (The team claims that its social footprint is larger than any other sports franchise.) In recent months, FC Barcelona has, via CAA, inked arrangements with three very different marketers. Its three-year pact with Gatorade seems like a natural fit, as the electrolyte beverage is on the sidelines with many teams in various sports. Riffing on the famous “Intel Inside” positioning, FC Barcelona players in December began wearing jerseys with the tech titan’s emblem visible only when they pulled the garments over their heads, something soccer players have been known to do after they score. (The Intel deal is reportedly worth $25 million for five years.)

The team’s four-year program with Stanley Black & Decker covers signage, co-branded promotions (match tickets, merchandise, meet-and-greets with players) and live events like the 2015 Global Striker Challenge. “We’re barely one month into our partnership, and we already have 21 countries confirmed for Barcelona-related promotional activations,” says Earle Smola, director, corporate brand design and sponsorships at Stanley, which also has deals with MLB’s New York Yankees and Boston Red Sox, the NBA’s Indiana Pacers and Nascar, among others. “Sports provide our brand teams with opportunities to connect with a diverse range of demographics through programs that consumers are truly passionate about.”

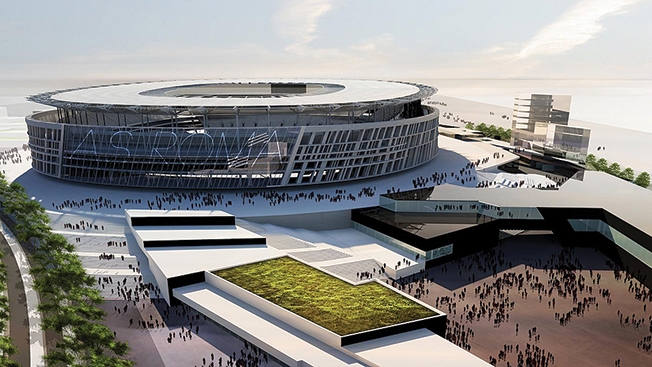

Thus, in our fickle, fragmented media age, teams, leagues and players can make desirable long-term promotional partners, says James Pallotta, the billionaire investor who serves as president of Italian soccer team AS Roma and holds a small stake in the NBA’s Boston Celtics. “Sports mean so much more than a movie or TV shows,” he says. “Star Wars is not your movie. Roma is your team—it’s your family’s team.” Pallotta believes he can leverage such ardor to “build out a brand and content company.” Its hub is a 52,000-seat stadium and entertainment complex, slated to open during the 2016-17 season. In addition to hosting home games, the facility—more like a small campus with year-round event potential—will include shops, restaurants, performance spaces, a boutique hotel and a video production studio.

Global Playbook

While soccer is in the lead, other sports are playing smart and hard to increase their global footprint. The National Basketball Association, National Football League and Major League Baseball are staging more games overseas to attract new fans and sponsors.

While soccer is in the lead, other sports are playing smart and hard to increase their global footprint. The National Basketball Association, National Football League and Major League Baseball are staging more games overseas to attract new fans and sponsors.

Basketball ranks as the No. 2 global team sport, and the NBA is running a full-court press, broadcasting games in 215 countries in 47 languages while maintaining international offices and social outreach efforts such as NBA Cares. This strategy appears to be paying off. New international partnerships from the 2013-14 season include Samsung (Mexico) and Kumho Tire (Korea). Plus, 30 percent of the NBA’s merchandise sales are from outside the U.S. “There’s still plenty of upside,” says NBA deputy commissioner and COO Mark Tatum. “We’re still growing.”

A global focus can yield sponsorships on the team level as well. MLB’s Los Angeles Dodgers—long known for the international flavor of its roster, which currently features South Korean pitcher Hyun-jin Ryu—recently added sponsorships from Korean firms LG, Hankook and Nexen. In fact, the Dodgers kicked off the 2014 season with a pair of games in Australia against the Arizona Diamondbacks. Such trips “expand our business and provide more touch points,” says Dodgers CMO Lon Rosen. (The Dodgers and Adweek are owned by affiliates of Guggenheim Partners.)

Non-team sports can also benefit. Nascar has been on a fast international growth track. “We have been successfully adapting our proven formula to suit local conditions and deliver value for sponsors,” says COO Brent Dewar. “Mexico is seeing rapid growth in Nascar interest—with sold-out venues and five new tracks that have been built since the introduction of the Nascar Mexico Toyota Series. We look to this series as a way to both develop international drivers and stoke the passions of our Mexican fans.”

Only a few stars will emerge as global brands (and branding platforms) unto themselves. Icons like Michael Jordan, Tiger Woods and David Beckham are in a league of their own. Nike’s Jordan Brand has become a $2 billion business that pays the long-retired M.J. an estimated $60 million per year. Tiger’s many endorsements, combined with his PGA winnings, made him the first professional athlete to top $1 billon in earnings. And Beckham is involved in everything from H&M’s David Beckham Bodywear to his own fragrance line and even Haig Club scotch from Diageo.

It remains to be seen whether the latest roster of sports stars joins the pantheon of those endorsement gods.

No comments:

Post a Comment